In Which Of The Following Types Of Temporary Insurance Protection Does The Death Benefit Not Change

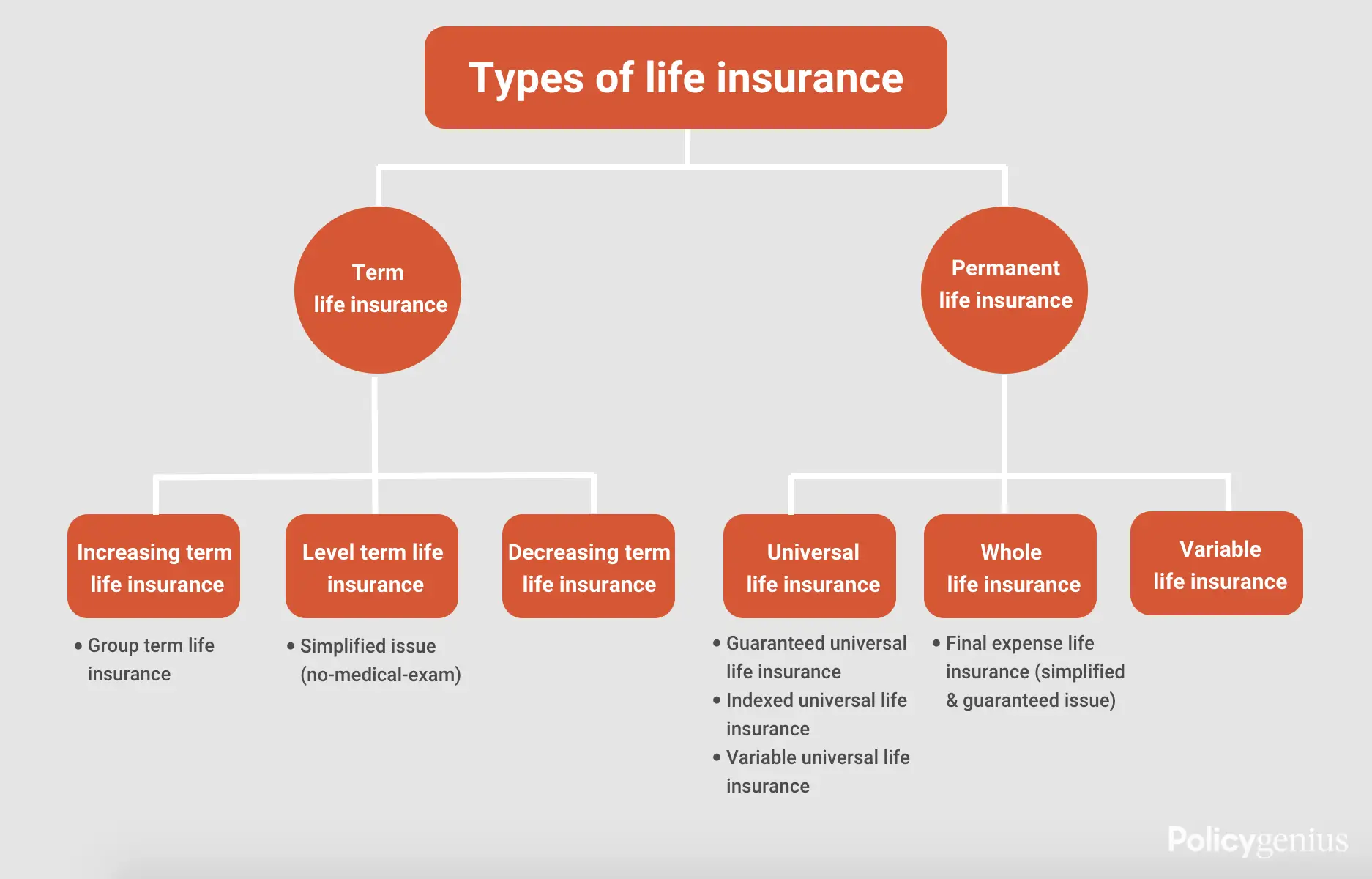

Shopping for life insurance tin seem overwhelming, simply deciding which blazon of policy you lot demand is simple. There are simply two chief policy categories to choose from: term life insurance and permanent life insurance. Term life insurance (the most popular type of life insurance) lasts for a specific corporeality of fourth dimension, while whole life insurance (the virtually popular blazon of permanent coverage) lasts your entire life.

One time yous decide betwixt term and permanent coverage, you're already halfway to the finish line. We'll explain the differences between the two, likewise as the options inside term and permanent life insurance available so you tin cull the ane that suits you lot best.

Fundamental Takeaways

-

Term life insurance is the simplest and almost affordable option for most people.

-

Whole, universal, and last expense life insurance are all types of permanent life insurance.

-

Some types of permanent life insurance come with a cash value amount that works like an investment account.

-

Some types of life insurance policies are categorized based on medical underwriting or the lack thereof, such as guaranteed issue life insurance.

Term life insurance

Term life insurance lasts for a set number of years before information technology expires. You pay premiums toward the policy, and if you dice during the term, a set amount of coin, known as the death benefit, is paid to your designated casher . The death benefit can be paid out as a lump sum, a monthly payment, or an annuity. Well-nigh people elect to receive their death benefit every bit a lump sum to avoid taxes.

-

Benefit: affordability Term life insurance policies are less expensive than other types of life insurance policies and generally take lower premium costs.

-

Downside: length Term life insurance has an expiration date, which can align with a mortgage or when your children graduate college. Those looking for lifelong coverage should opt for permanent life insurance instead.

-

Who it's for: most life insurance shoppers Those looking for cheaper life insurance for upwards to 30 years should buy term life insurance.

→ Learn more near term life insurance

Whole life insurance

Whole life insurance is the most popular type of permanent life insurance. It also pays out a death benefit, but unlike term life, most policies have a cash value, an investment-like, tax-deferred savings account, included in the policy.

-

Benefit: greenbacks value & lifelong coverage The cash value component can comprehend endowments or estate plans. And since this coverage lasts for your entire life, it can help support long-term dependents such equally children with disabilities.

-

Downside: cost & complexity A whole life insurance policy can cost v to 15 times every bit much as a term life policy for the same death benefit amount, based on Policygenius data in Jan 2022. The cash value component makes whole life more complex than term life considering of fees, taxes, interest, and other stipulations.

-

Who it's for: younger buyers who can pay more than People who conceptualize lifelong dependents or a demand for permanent insurance with minimal complexities can benefit from whole life.

→ Acquire more about whole life insurance

Universal life insurance

At that place are iii types of universal life insurance (UL): indexed universal life insurance (IUL), guaranteed universal life insurance (GUL), and variable universal life insurance (VUL). All have a greenbacks value, only like a whole life insurance policy. Your premiums go toward both the greenbacks value and the decease benefit.

Dissimilar whole life insurance, universal life insurance allows you to decrease (or increase) how much y'all pay towards premiums (flexible premiums) and allows for adjustable death benefits. If you decrease how much you spend on premiums, the difference is withdrawn from your policy's cash value.

Indexed universal life insurance

Indexed universal life insurance is the most pop blazon of UL. The cash value account has a minimum (and maximum) guaranteed involvement charge per unit based on a stock market index (like the S&P 500), called by the insurer.

- Benefit: cash value gains

At that place's a potential to see bigger gains in the cash value account compared to other permanent life insurance policies, depending on stock market place performance. - Downside: investment caps

Near insurers ready limits on cash value gains. You lot won't lose your base cash value, merely dedicated investment accounts will offering higher returns. - Who it'southward for: portfolio enhancers

If you've maxed out other investment accounts or are looking for a relatively safety investment with guaranteed minimum values IUL might be correct for you.

Guaranteed universal life insurance

Guaranteed universal life insurance is universal life insurance without the market risk. Your premiums stay the same regardless of how market indexes perform, equally your plan's interest rates are baked into the premiums when yous sign upwardly for the policy. This type of life insurance has a "no-lapse" guarantee, meaning that equally long equally you pay your premiums, you'll accept coverage.

- Do good: stability

Guaranteed universal life insurance provides lifelong coverage without the market place fluctuations of indexed or variable policies. - Downside: no cash guarantee

Different some permanent life insurance, GUL doesn't allow for premium payments from the cash value account. If you skip a premium payment, your policy will lapse. - Who it's for: risk-averse people with permanent insurance needs

Guaranteed universal life insurance is a relatively affordable permanent selection, sort of like a term life insurance policy where the term lasts the rest of your life.

Variable universal life insurance

Variable universal life insurance has a variable involvement charge per unit set by the life insurance visitor. Cash value is invested in mutual funds that tin can increase or decrease. Information technology shares elements from universal and variable life insurance policies.

- Benefit: cash value gains

There's a potential to see bigger gains in the cash value account compared to other permanent life insurance policies, depending on your investment choices. - Downside: too hands-on

The policyholder, not the insurance visitor, manages the investment portfolio. Dissimilar other types of permanent insurance, you lot'll need to manage your own cash value investments or work with a carve up financial advisor. - Who information technology's for: DIY investors

There's a big potential upside for policyholders who don't mind beingness involved in money management.

→ Acquire more nigh universal life insurance

Variable life insurance

The money paid into a variable life insurance cash value goes into a series of mutual fund-similar sub-accounts where you tin can go some decent growth, simply yous can also lose coin depending on the market place. This type of policy's greenbacks value is more alike to investing.

While this makes variable life insurance policies a better investment option than whole life insurance policies — with potential for higher, revenue enhancement-deferred growth — you can but invest in the sub-accounts available through your policy. All of this makes a variable life insurance policy both a express investment pick and a limited coverage option.

-

Benefit: savings potential Similar to variable universal life insurance, policyholders can see greater greenbacks value gains with this type of policy over other permanent products.

-

Downside: high risk for policy lapse Both the cash value and death benefits can fluctuate based on your portfolio's performance.

-

Who it's for: hands-on investors who don't mind risk For those who want to take control of their own investment portfolio, there's potential for cash gains.

→ Learn more about variable life insurance

Final expense insurance

There are ii types of last expense life insurance, which autumn nether the whole life insurance category: simplified issue life insurance and guaranteed issue life insurance.

Simplified result life insurance

Simplified consequence life insurance allows yous to fill up out a health questionnaire and skip the medical test. This is also known every bit a type of no-medical-exam policy.

- Do good: burying costs

This type of insurance covers the toll of anything associated with your death, including medical care, a funeral, or cremation. Information technology'due south useful if you don't have another way to pay for your funeral and don't want to brunt your family with the costs. - Downside: cost & health limitations

If you're over a sure age, have severe underlying medical conditions, are unable to independently make full out the application, or are a smoker, you may not qualify for simplified issue life insurance. - Who information technology's for: seniors without major medical issues

It's likewise a good option for adult children looking to purchase life insurance for their aging parents to cover final expenses.

Guaranteed issue life insurance

Guaranteed issue life insurance skips both the medical exam and the health questionnaire. As long equally you can pay the premiums and fill out the awarding with info about your age, sex, and residency, the insurer will cover you. If an applicant cannot reply questions on the application due to avant-garde dementia or Alzheimer'due south, then they would not qualify for guaranteed consequence life insurance.

- Benefit: burial costs

Guaranteed issue offers similar benefits to simplified result policies. - Downside: cost

Like other types of final expense life insurance, these policies take higher premiums for relatively low coverage amounts (typically upwardly to $50,000). - Who it'southward for: seniors or people with final illnesses

For older people or those with declining health, guaranteed issue life insurance might exist the only option bachelor.

→ Learn more than about concluding expense life insurance

Group life insurance policies

Grouping life insurance is an employee benefit provided by some employers that is a type of term life insurance chosen almanac renewable term. It isn't technically a type of life insurance, but it'southward important to know how information technology's different from privately purchased life insurance.

About people recall their employer-sponsored life insurance is enough coverage when in near cases information technology isn't. Make no mistake: If your employer is offering life insurance at no extra cost to y'all, information technology's a great benefit. By all means, get insured. But if you demand life insurance to protect your family unit, employer-provided coverage may not be sufficient.

→ Learn more nearly grouping life insurance

How the types of life insurance stack up

| Life insurance blazon | Duration | Expiry benefit | Premium | Cash value |

|---|---|---|---|---|

| Term life insurance | 10 to 30 years | Fixed | Level* | No |

| Whole life insurance | Life | Fixed | Level | Yes; guaranteed |

| Universal life insurance | Life | Adjustable | Flexible | Yes; guaranteed |

| Variable life insurance | Life | Variable | Level | Yep; non guaranteed |

| Final expense life insurance | Life | Fixed | Level | No |

| Group term life insurance | one year | Fixed | Level | No |

*Increasing and decreasing premium term life insurance policies also bachelor.

What blazon of life insurance is all-time for you?

Term life insurance policies are usually the all-time solution for most people who demand affordable life insurance for a specific menstruation in their life. Permanent life insurance policies including whole life insurance are all-time for people who can pay more and want life insurance that will never expire.

Simplified consequence and guaranteed issue life insurance are options for people who might not be able to otherwise get insured because of age or poor health and elderly consumers who don't want to burden their families with burial costs.

Y'all should e'er speak to a licensed independent broker or a financial advisor to determine the best insurance company and policy for you. They can assist you weigh the pros and cons of each type of coverage and help yous buy the right type of insurance for your needs.

Frequently asked questions

What types of life insurance are there?

The main two categories of life insurance are term life insurance (which lasts for a prepare term) and permanent life insurance (which never expires). Whole, universal, indexed universal, variable, and last expense are all types of permanent life insurance. Permanent life insurance typically comes with a cash value and has higher premiums.

Which type of life insurance policy combines insurance and investing?

The cash value component of permanent life insurance policies can be used to save or invest. But because cash value policies have more expensive premiums, express investment options, and offering relatively low rates of return, they should not be used as a principal savings vehicle.

What kind of life insurance should I go?

The right life insurance policy for yous depends on your financial state of affairs and your dependents. Term life insurance is the best choice for most people because it'southward more affordable, just whole life insurance makes sense for people who need lifelong coverage or those looking for insurance with a cash value.

Source: https://www.policygenius.com/life-insurance/types-of-life-insurance/

Posted by: cooperhavine.blogspot.com

0 Response to "In Which Of The Following Types Of Temporary Insurance Protection Does The Death Benefit Not Change"

Post a Comment